CURENTIS relieves you of the work involved in the Money Laundering Act so that you can concentrate on your core business. Use YourKYCplus.

With YourKYCplus you solve the following problems for your company:

- Too little prevention: Measures to prevent money laundering are not sufficiently implemented.

- Too little information and time: Lack of knowledge and time to deal with money laundering requirements.

- Violation of reporting obligations: Insufficient documentation or non-compliance with the identification obligation.

- Lack of qualified personnel for the topic of money laundering prevention.

YourKYCplus enables you to meet your due diligence and reporting obligations under money laundering law efficiently and cost-effectively and avoid penalties. We relieve you of these obligations cost-effectively and efficiently. This is your plus for processing corporate customers.

Your advantages with YourKYCplus

Simple: |

Current customer documents quickly verified. |

Digital: |

Digital identification of natural and legal persons. |

Current: |

Current excerpt from the Commercial Register for domestic and foreign companies. |

Compliant with the law: |

In compliance with the current Money Laundering Directive. |

Cost-effective: |

Instead of expensive in-house expertise, you use an efficient outtasking solution. |

How YourKYCplus works

Onboarding corporate customers in compliance with the law in just a few steps

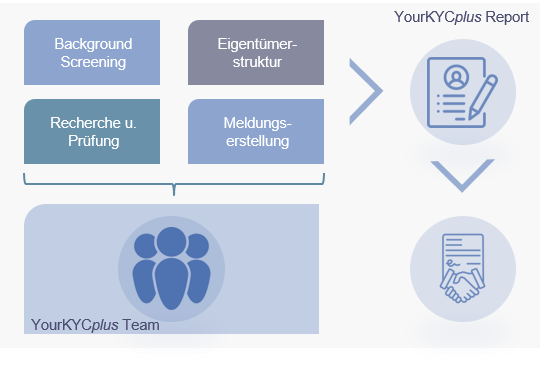

Efficient to all necessary customer data

You simply submit your existing information on new customers to the YourKYCplus worklist. The YourKYCplus teamwill research all relevant missing information for you and make it available in your YourKYCplus report. This saves you the effort and you only have to file the data and information with you.

YourKYCplus Report

You receive an aggregated and clear YourKYCplus report. The report compiles all the information and provides a recommendation on how to proceed. The report shows you whether it is advisable to report suspected money laundering.

Prepared money laundering suspicious activity report

Our experts will prepare the money laundering SAR for you. All you have to do is forward it to the FIU and fear no consequences of non-action.

Together for a better KYC process and against money laundering: CRIFBÜRGEL cooperates with CURENTIS

CRIFBÜRGEL is cooperating with CURENTIS AG with immediate effect to further enhance the quality of efficient KYC processes and to set new standards in anti-money laundering together with CURENTIS. The consulting company is a specialist in banking supervisory reporting, financial crime prevention and IT compliance and complements CRIFBÜRGEL's comprehensive services for customer identification in the area of special and exceptional cases of corporate customer onboarding. More info ...

Contact us

Do you have any questions? Would you like to learn more about our products? No problem, just write to us! We will be happy to answer your questions and look forward to hearing from you.

CRIFBÜRGEL launches KYC MORE: MLA-compliant corporate customer onboarding digitally and efficiently

CRIFBÜRGEL launches KYC MORE: MLA-compliant corporate customer onboarding digitally and efficiently